Expat Service

An online portal where expats can easily and quickly file their personal income tax and gift tax returns (P, M and C forms).

Available 24/7

Where and when you want, you can file your tax return. No more paperwork, all tax forms in English and completely digital.

Free tax optimization

Included in the price is that an expert checks your tax return for completeness. This can save you thousands of euros in tax.

Beste price guarantee

Because you handle many things with our tax return software yourself, we can offer the best prices.

Security

We apply only the highest possible security requirements, including those of the programs we work with. All operations are GDPR proof.

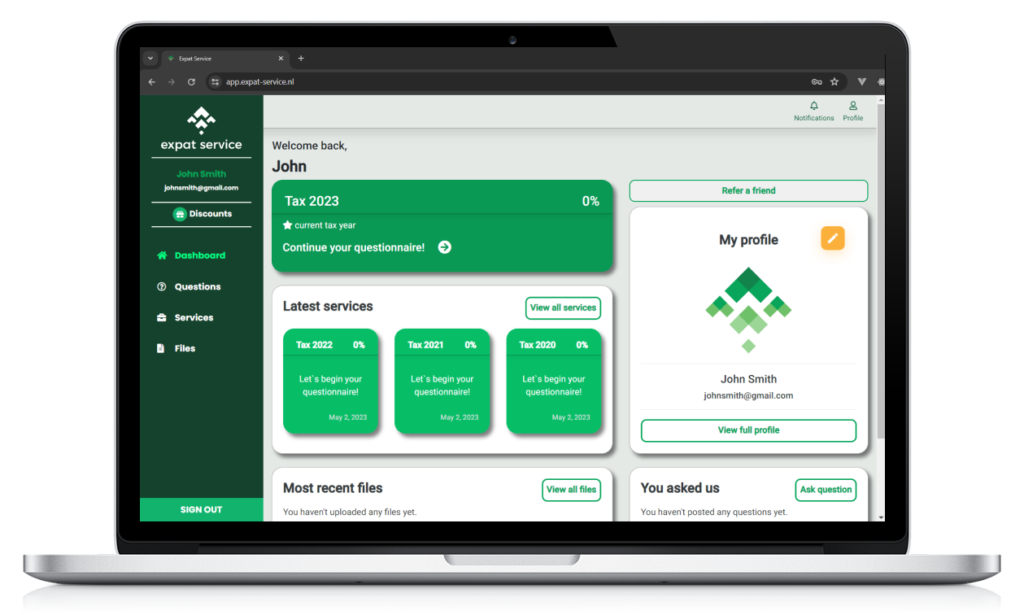

How does our online portal work?

With our online portal, we help expats meet their Dutch tax obligations quickly. Both income tax and gift tax.

Expats can easily file their returns by following the following 3 steps:

- Aanmelden via de volgende link: https://app.expat-service.nl/intake. Hier wordt de naam, emailadres en het telefoonnummer ingevuld.

- After that, the expat should fill in the questionnaire so that we have all the information we need to prepare the tax return.

- Once the questionnaire is completed, one of our tax experts will prepare the tax return in draft form. After the expat's approval, we will submit the tax return digitally to the Tax authorities.

What clients say about Expat Service

Read more about expats' experiences with Expat Service's online portal.

50+

Reviews from satisfied clients

Through our portal you can arrange your income tax returns for the Netherlands. You can go through a questionnaire for the specific tax year. These questions are in english. For each question there is also a short explanation. You can therefore arrange your income tax returns in no time. For the next year, you can use the portal again and arrange your tax return quickly.

After completion and approval of your Dutch tax return, we will electronically file your Dutch tax return(s). If the Dutch tax returns are filed before May 1, 2023 (for 2022 Dutch tax return), the Dutch tax authorities will inform you before the end of July 2023. Otherwise it will take 3-6 months after the date the returns were electronically filed.

We charge a fixed price for income tax returns. You can find the current prices on the website of Expat Service. We are also happy to provide other services. We employ tax specialists who have extensive knowledge of expat-related issues. If you have a specific question or would like to receive advice on a particular subject outside of income tax returns, please complete the contact form. We will contact you to discuss your situation.

Frequently asked questions about Expat Service

Find answers to Expats' most frequently asked questions about Expat Service here.